The Central Bank of Nigeria has granted OPay Digital Services Limited a license to operate a mobile money platform. Since its inception in June 2018, the company has expanded its services to include over 300,000 mobile money merchants in all 36 states of Nigeria.

Opay, What is OPay and does it work?

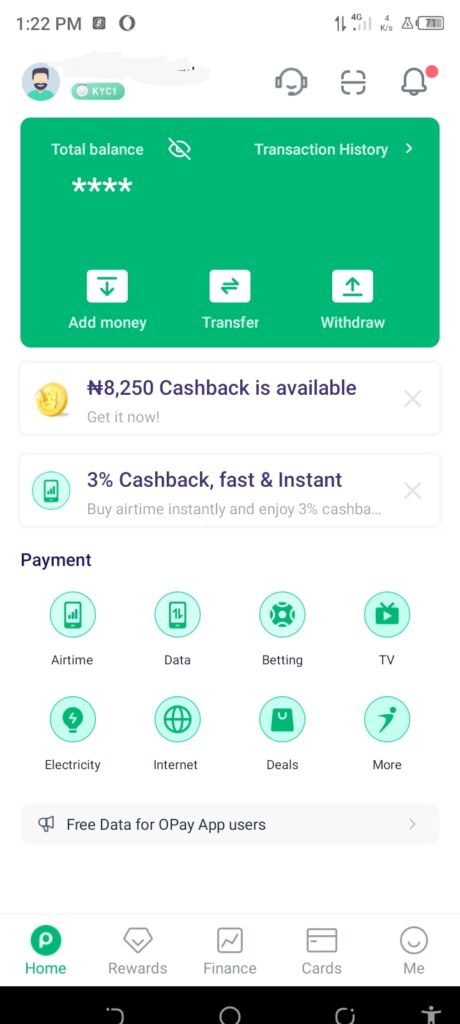

OPay is a mobile-based payment, transportation, food and grocery delivery, and other key services in your daily life all in one place. OPay is used by millions of people every day to transfer and receive money, pay bills, and place food and grocery orders.

Opay is own by Opera software company, the company that owns the popular Opera mini web browser. The launch was made after Opera acquired paycom.

Opay is a financial services which gives you the freedom to make quick payments easily from the comfort of your own home or on the go Pay for your cable TV, power, water, school, tolls, taxes, and other expenses and spend wisely.

Opera has created a few services that only take OPay as a payment mechanism in order to increase OPay usage. OPay is the unique payment mechanism accepted by Opera services such as ORide, OTrike, OFood, OBus, OWealth, OLeads, OKash, OCar, OList, and so on.

With the OPay app, you can quickly recharge your phone without having to go out and buy airtime. You can simply download the OPay App from the Google Play Store and begin using it to recharge your phone and purchase data plans directly from your app.

You also need to fund your opay wallet in other to perform all the above actions and enjoy opay services.

What you can Do with OPay App

Wondering what you can do with OPay mobile app? See the list of what you can do with OPay below:

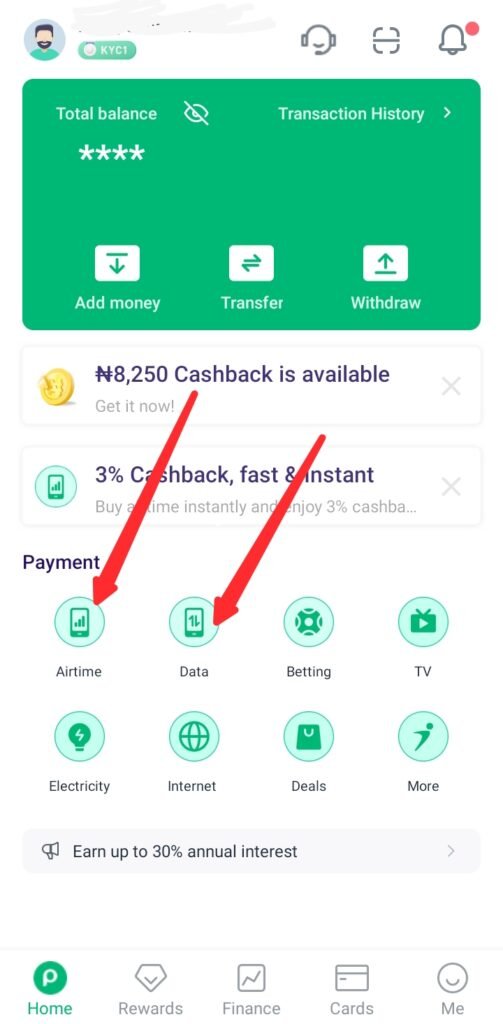

- Buy airtime: You can use opay to buy airtime for yourself and others, it doesn’t matter if you are an MTN, GLO, Airtel or 9mobile users, opay currently support them all.

- Buy data: You can also use opay to buy data for yourself and others, it doesn’t matter which network user you are, because it currently support them all, GLO, Airtel, MTN and 9mobile.

- Fund your betting account: You can use opay to fund your betting account, opay currently support’s livescorebet, Bet9ja, Sportybet, Betking, 1×bet, betway, Merrybet, Melbet, Bet9ja agent wallet funding, Nairabet, Mylottohub, Cloudbet, Paripesa, Naira million, Naijabet, Bangbet.

- TV subscription: With opay, you can subscribe to startime, DStv, GOTV.

- Pay electricity bills: With opay, you can now pay electricity bills to electricity distribution companies, currently supported in Kano, Abuja, Ikeja, Eko, Ibadan, Kaduna, Jos, Enugu and Port Harcourt.

- Connect with friends: Chat with family and friends on the app. Send money to them with zero charges through our wallet-to-wallet payment system.

- List your products and services using OList.

- Savings

- You can use opay to transfer money

- Food ordering

- Pay with QR

- Receive payment with QR

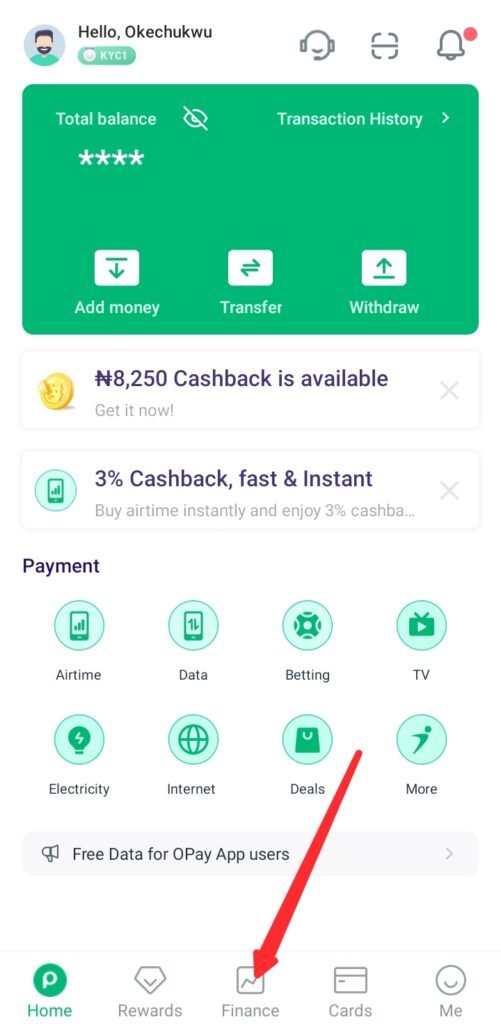

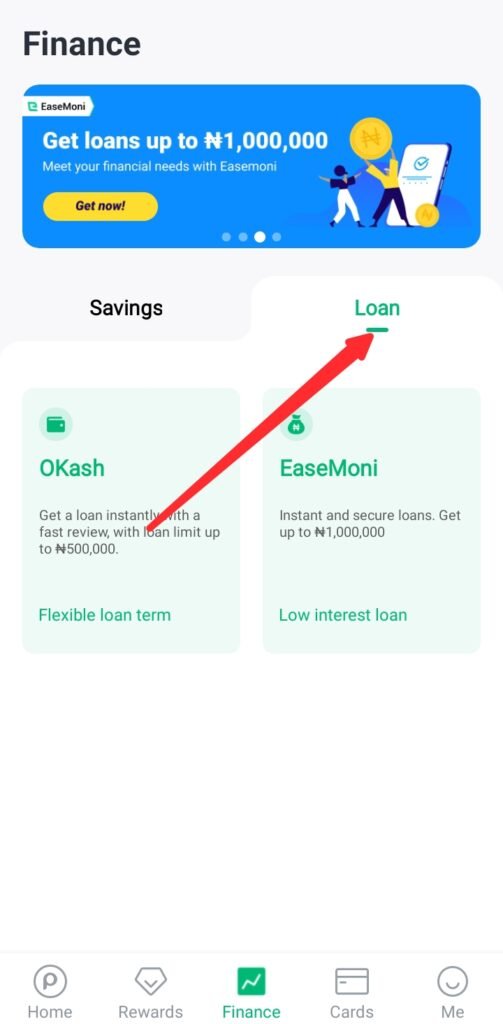

- Get Loans easily by using OKash

- Make investment

- Build online presence using OLeads.

What is OPay business app?

OPay business App meets the retail demands of practically all types of businesses, offering quick checkout, business payment, bank transfer, staff or store administration, and other useful features to make your business easier, safer, and more efficient.

What you can do with OPay business app

Opay business app is an all in one app for business success, you can:

- Use Multi-channel payment

- Create sub-accounts

- Auto-Split your funds across transaction

- All You Need to Keep Customers Loyal

- Create your Product Inventory

- Create and manage multiple stores on one App

- Download your statement

- Carry out Bank Transfer to all Nigerian banks

- Buy Airtime, Data and Pay bill

- Add and manage your team members

- Generate report that gives you insight to your business

- Make A Poster In One Minute & For Free

- Build Your Web Store & Sell Online

- Don’t Enter Manually, Scan Barcodes

- View Your Business Performance at A Glance

How to download OPay business app for Android and iOS

Opay business app is available on app store on iOS and Android.

- Using your web browser, navigate to www.opayweb.com.

- Click on any of the application stores that correspond to the device you are using from the options and recommendations.

- Navigate to your phone’s app store and download the Opay app.

- Install the app and get set to talk with your friends and family in it, as well as send money to them with discounts and no fees.

The steps above is applicable to android and iOS.

How to download OPay app for Android and iOS

Opay business app is available on app store on iOS and Android.

- Using your web browser, navigate to www.opayweb.com.

- Click on any of the application stores that correspond to the device you are using from the options and recommendations.

- Navigate to your phone’s app store and download the Opay app.

- Install the app and get set to talk with your friends and family in it, as well as send money to them with discounts and no fees.

How to open OPay account/sign up/registration

To OPay account, register or sign up, follow the steps below:

- First move to your phone app store

- On the search bar, type”OPay” and click on search.

- Now download and install OPay

- Provide the information needed to register or sign up.

How to check/get OPay account number

How to check or get your OPay account number? It’s pretty simple to get your OPay account number, all you have to do is download OPay app and sign up, the phone number you provided during registration is your OPay account number. At these point, you have to remove the first digit on your phone number.

For instance, if your phone number is 08088752067, remove the first zero and you have 8088752067 a proper 10 digit account number.

How to login to OPay, steps to step guide

Opay login with email and number

- Open your OPay app

- Fill in your login credentials

- Enter your password

- Press login to login to your dashboard.

OPay login with phone number in Nigeria

You are required to login to your OPay account using phone number when you forget your login credentials, click on forgotten password to proceed.

How to unlock my OPay account

Follow the steps below to unblock or unlock your OPay account:

- Verify your email address and phone number to complete your account registration.

- Enter your BVN and link it to your OPay account.

- Complete your KYC (Know Your Customer) process. The Central Bank of Nigeria has established KYC levels to prevent identity theft and financial fraud. Opay offers up to four levels of KYC, including agent level.

- Contact OPay via their customer service number, email address, or social media sites.

How much can OPay account receive?

The basic transaction limit on OPay is NGN 50,000 before you are requested to provide further details.

As for how much your OPay account can receive, there seems to be no limitation.

How much can you transfer on OPay?

You can transfer up to two million naira to your OPay account/wallet at once using your bank app.

Can OPay account receive money from abroad?

Opay is doing anything possible to ensure smooth payment, to answer the question, yes you can receive money from abroad to your OPay Wallet.

Can you use OPay without a bank account?

If you don’t have a bank account, don’t panic you can still use opay. To fund your account if you don’t have a bank account, you’ll need to use an OPay agent. You hand over cash and your OPay number, and they deposit the electronic value in your OPay wallet.

Which bank does OPay use?

GTBank, First Bank, Access Bank, Zenith Bank, UBA, Stanbic IBTC, Diamond Bank, Wema Bank, Sterling Bank, FCMB, Union Bank, and Heritage Bank are among the banks that now support direct transfers to OPay.

How much can OPay account hold without BVN?

The basic transaction limit on OPay is NGN 50,000 before you are requested to provide your BVN.

How to become an OPay Merchant

You have the power and control as an OPay Merchant to generate as much money as you want while offering financial services and helping your business develop. Get a free POS and start growing your company. In Nigeria, Opay has the lowest fees.

How to get started

- Download the OPay app from the Google playstore or Apple app store.

- During sign up, provide all the required information for approval.

- Earn commissions for transactions you make on the OPay merchant app.

How do I set up an OPay merchant account

It’s quite simple! Download OPay from Google Play. Then, to register your account, simply follow the on-screen instructions.Send an email to ng-support@opay-inc.com after you’ve set up your account, asking an OPay merchant registration form.

Qualifications/ requirements for OPay merchant registration

- Your Bank’s Verification Code (BVN).

- As verification of your address, provide a utility or other bill dated no more than three months prior to merchant registration.

- A copy of your national identification card, driver’s license, or international passport.

- 1 passport photograph

After registration, Begin sending and receiving money. To complete a transaction, you only need the phone number of another OPay user. Your consumers can also make payments to you.

You can receive and send up to 5 million Naira daily as an OPay merchant.

Benefits of been OPay merchant

In every business, there is benefits, been an OPay Merchant also comes with benefits.

- Trusted and Reliable Service: OPay is a CBN licensed mobile money platform. They offer low fees and a hassle-free way to carry out an array of services for your customers.

- Instant Transaction Settlement: Instantly receive funds into your wallet and provide real-time transfer services to your consumers. There’s no need to wait for the end-of-day reconciliation.

- Business Intelligence and Growth Insights: OPay offer a powerful dashboard to view all your business transactions and helps you understand your business better.

- Make money: You have the ability and control as an OPay Merchant to generate as much money as you want by providing financial services in your community.

- Airtime / Data: Get discount when you buy airtime or data on OPay app.

- TV subscriptions:When you assist your customers in paying for their TV subscriptions, you will earn extra commission. There are no charges!

- Fast & Secure Transfers: You can send and receive money from any bank in real time using your OPay account for as little as 10 Naira.

- Savings: When you save in any of OPay’s savings solutions, you can earn up to 15% interest each year.

- Electricity: Make it easy for people to pay their electricity bills with the OPay app.

- Deposit / Withdraw: Turn your neighborhood become a bank. OPay gives you the ability to provide all consumers with deposit and withdrawal services.

- Free POS: Reduce the need for your consumer to visit the bank to obtain cash. Opay POS serves all purposes, from making withdrawals to providing all merchant business services, you can become the available stop for rapid cash in your neighborhood (Transfers, Pay bills, Savings etc.)

- All in one app: OPay app gives you all the tools you need to succeed.

- 24/7 support

What is OPay transfer code?

With the USSD code: *955#, OPay customers can buy airtime, send money, perform deposit and withdrawal transaction at an Agent’s from any mobile phone.

OPay USSD code for Glo?

To use the OPay USSD code, *955#, you must first set up an OPay account. The service enables you to conduct financial transactions using the mobile number associated with your OPay account.

How do I get my OPay OTP code?

OPay USSD code for OTP, dial *347*010# on the number you registered with OPay to get the otp.

How can I receive OTP if I lost my SIM card to receive an SMS?

If you lost your SIM card and can not received OTP, but you still want your account back. Request for a new SIM with the same old number and then request for another OTP.

OPay transfer code

Opay transfer code is *955#

OPay transfer limit

OPay transaction limit is ₦50,000 before you will be asked to provide additional information. You can send up to 2 million and receive up to 5 million.

OPay transfer charges

- For withdrawals below ₦20,000, OPay charges 0.5% of the transaction amount.

- For withdrawal above ₦20,000, OPay charges a flat rate of ₦100.

- For deposit from ₦5000 and below, OPay charges a flat rate of ₦10.

- For deposit from ₦5,001 to ₦10,000, OPay charges a flat rate of ₦20.

- For transfer above ₦10,000, OPay charges a flat rate of ₦30.

OPay POS commission structure for Data Top Up

- MTN = 3% commission

- Glo = 4% commission

- 9Mobile = 4.5% commission

- Airtel = 4% commission

OPay POS commission structure for TV Subscription

- DStv = 2% commission

- GOtv = 2% commission

- PHCN = 2% commission

- StarTimes = 2% commission

How much does OPay charge per transaction?

- For withdrawals below ₦20,000, OPay charges 0.5% of the transaction amount.

- For withdrawal above ₦20,000, OPay charges a flat rate of ₦100.

- For deposit from ₦5000 and below, OPay charges a flat rate of ₦10.

- For deposit from ₦5,001 to ₦10,000, OPay charges a flat rate of ₦20.

- For transfer above ₦10,000, OPay charges a flat rate of ₦30.

How do I transfer money Gtbank to OPay?

To use the USSD code to transfer money from your GTB account to your OPay account, dial *737*22#, pick mobile money, input the amount, enter your OPay number (which is also your phone number), select Opay, and then enter your mobile USSD pin to complete the transaction.

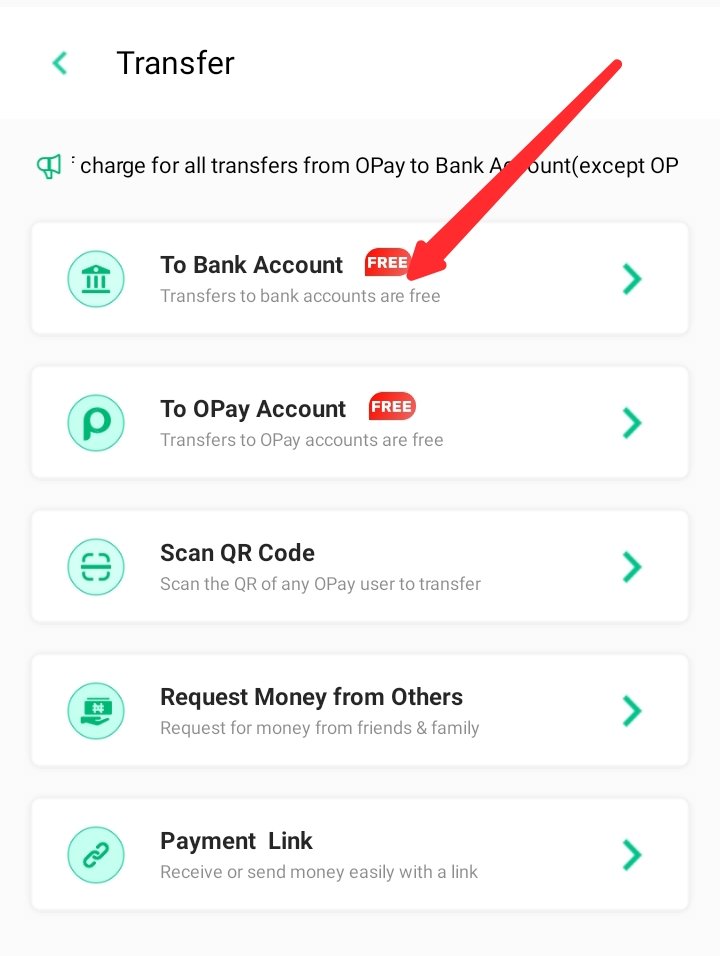

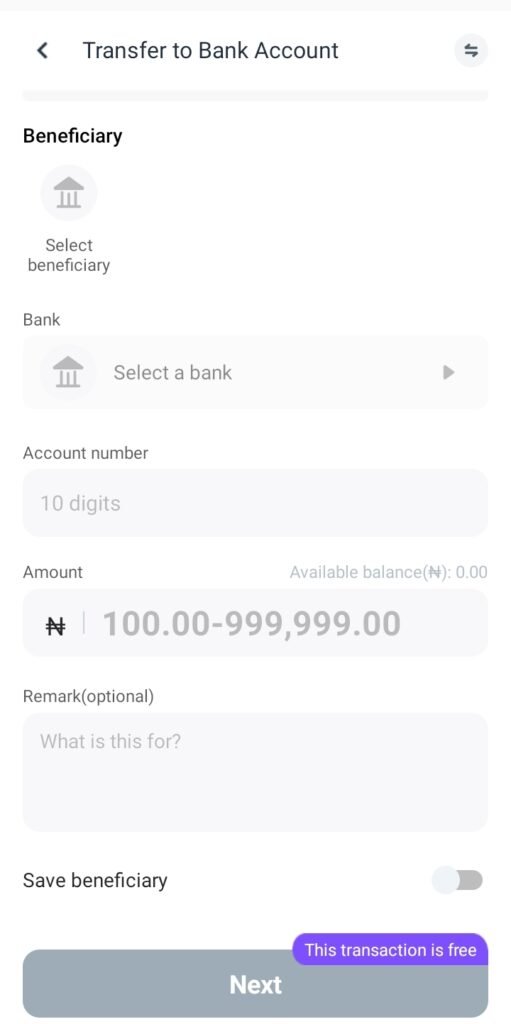

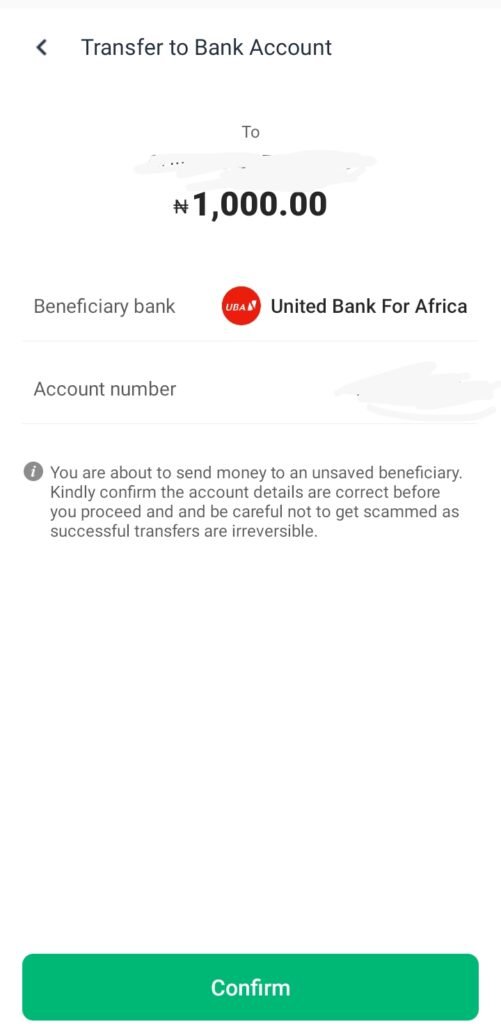

How to transfer money from opay wallet to other bank

If you want to transfer money from your OPay Wallet to another bank, follow the steps below:

Open your OPay app

Click on transfer

Choose transfer to bank

Select beneficiaries bank, enter account number, amount and optional remark.

On the next page, confirm your details

Enter your PIN

You will receive a message showing if your transaction was successful or not.

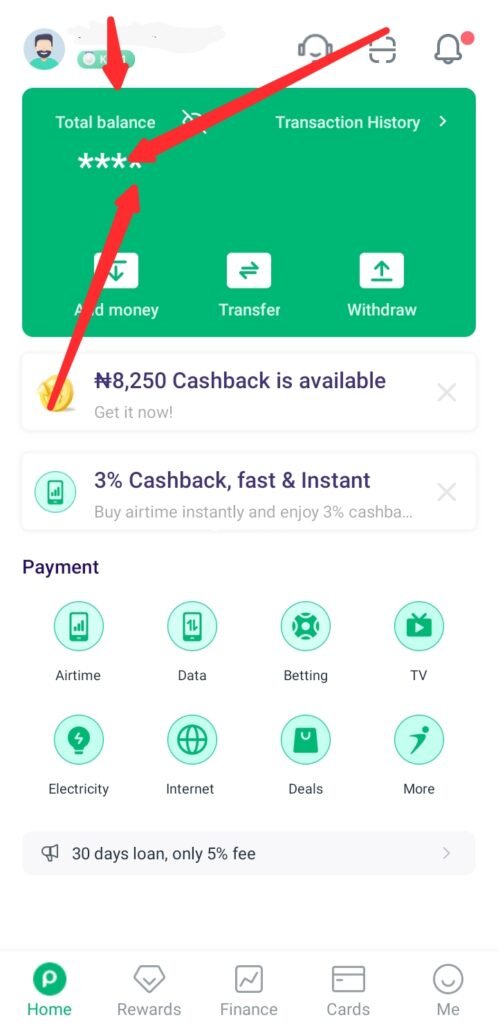

How to check OPay account balance?

To OPay account balance, open your OPay app, on the app dashboard, your will see your OPay account balance.

Can I buy airtime and data on OPay?

Yes! You can buy airtime and data on OPay app. Launch the mobile app to get started

Or you can also use OPay USSD code for easy banking, to buy airtime and data, make transfer etc. Dial *955#.

OPay customer care number

How to get in touch with OPay customer service, use the hotline: 018885040, for enquiry, call +23418888329, OPay email address: customerservice@opay-inc.com, ng-support@opay-inc.com or visit OPay official website: https://opayweb.com/

Opay whatsapp number

Opay official WhatsApp number is +234018888329, you can chat them up.

Opay email address

For support and help, contact OPay on ng-support@opay-inc.com.

Opay address

Alexander House, Otunba Jobi Fele Way. Ikeja. Lagos, Nigeria.

How many Agents Does OPay have Currently?

OPay boasts over 500,000 active agents and consistent service coverage. Pan-Nigeria is the country’s largest agency banking platform.

How to Become an OPay Agent

To become an OPay Agent, here is what you need to do:

- Visit the OPay website’s registration page.

- Fill out the page’s short form with your Phone Number, Name, Surname, Email Address, and State.

- Accept the terms and conditions and privacy policy of the company. Then press the “Sign up” button.

- The next step/instruction will be communicated to you by OPay. Typically, you will be required to produce a passport photograph, a utility bill, and proof of identification.

How to apply for OPay pos machine in Nigeria

Get a POS terminal and enjoy low fees on all your transactions. Create an online merchant account or create a POS merchant account.

- Log into the OPay app on your device.

- Choose the ‘Merchant Application’ icon.

- Enter all necessary information as requested.

- Upload your transaction history for the past 3 months.

- Upload a valid ID Card (Intl Passport, Voters’ Card, National ID, or Driver’s License).

- Take a snapshot of your business station and upload it to the portal.

- Submit your OPay POS application for review.

The OPay POS is free; however, agents must have a caution fee of 20,000 Naira available in their OPay wallets; immediately, the POS application is approved, the caution fee charge will take effect. This sum will be refunded to the agents when the agent returns the POS terminal.

Also read:

- How to block ATM card: everything you need to know

- How to transfer money from zenith bank to other bank, everything you need to know

- How to check zenith bank account balance, everything you need to know

- how to check uba account number using USSD code

- UBA USSD code full list, everything you need to know

Opay pos machine price in nigeria

The OPay POS application is free. Although you must retain at least N20,000 in your OPay Wallet, it’s called a caution fee. Immediately the POS request is approved, the caution fee is taken from your wallet. The N20,000 will be refunded only when the agent returns the POS terminal.

What are the requirements to get OPay POS?

You must have an OPay account. You must have worked as a POS Agent and be familiar with how various transactions are completed utilizing a POS machine. Your OPay account must have a solid transaction history.

How long does it take to get OPay POS?

Within 24 hours, all OPay POS requests are examined and processed. Once your POS terminal request has been authorized, the agent support team will call you to tell you of the best available day for you to pick up the POS terminal.

How do I get OPay POS for free in Nigeria?

- Download the OPay app from the Google playstore or Apple app store.

- During sign up, provide all the required information for approval.

- Earn commissions for transactions you make on the OPay merchant app.

How to Fund your OPay Wallet

You can fund your opay wallet using two methods after downloading the app. You can use either ATM, USSD code, cash deposits, QR scan code or your bank app.

ATM method

- Go-to balance

- Click on Add Money

- Select Add new payment options

- Click on the card icon

- Input your card details

- You’ll be redirected to the authorization page for you to input OTP and you’ll be credited.

Bank app method

- Open your bank app

- On the list of banks, select paycom or OPay.

- Input the amount you

USSD code method

- Open OPay app

- Click on add money

- Click on bank USSD

- Select bank and enter amount

- Dial the USSD code to add funds

Note: USSD code invalid after 5 minutes

Cash deposits method

- Give cash to POS agent and ask for cash transfer to your OPay account

- Confirm your account has been funded

QR scan code method

Visit the nearest OPay user/merchant and ask them to scan your QR code with there OPay app or OPay POS.

How to Withdraw from your OPay Wallet

OPay users can utilize an OPay agent to either transfer money from their OPay wallet to their bank account or withdraw cash.

OPay agents are OPay representatives who assist consumers with OPay transactions. You must visit an OPay agent nearest to your residence and transfer monies from your OPay wallet to the OPay agent’s OPay wallet.

Once the transfer is complete, the OPay agent will give you the cash equivalent of the funds deposited to his OPay wallet.

Withdrawing funds from your OPay wallet with the assistance of an OPay agent may incur fees.

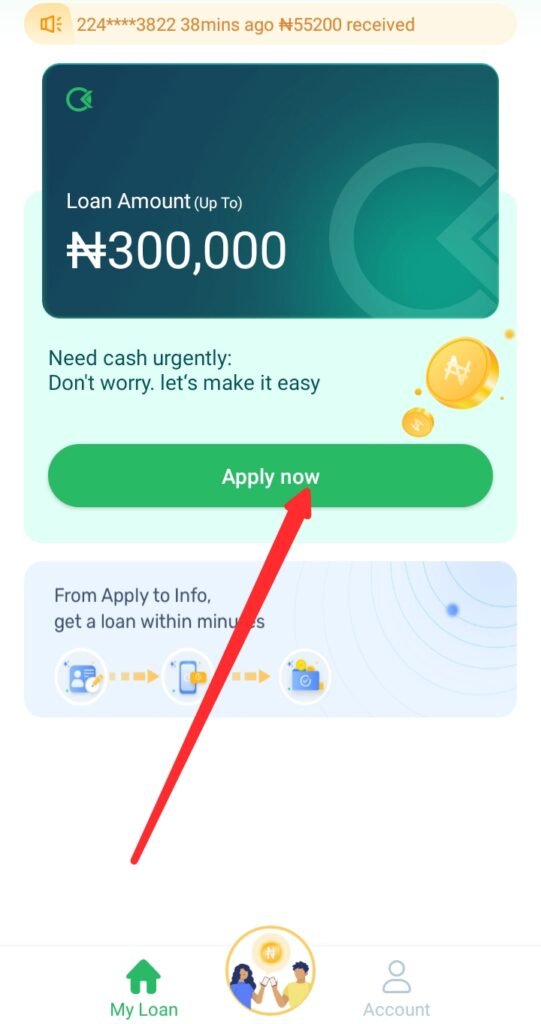

How to borrow money from opay (OKash)?

If you want to borrow money from OPay, first you have to download OPay, register or login.

Request for loan from your OPay app

Use OKash, apply for loan

Read there terms and conditions, check the interest rate and repayment date, fill in the necessary details and confirm your request.

You will be credited in minutes.

Opay Loan USSD Code

Opay loan USSD code is *955#. This USSD code allows you to perform your transaction smoothly only if you have an account already created on the platform.

i hope you found this article to be helpful, please don’t forget to click the share button, I would love to hear what you think in the comment section. Thanks for stopping by.