United Bank for Africa Plc (UBA) is a multinational pan-African financial services organisation with its headquarters in Lagos and is referred to as Africa’s Global Bank.

It maintains offices in London, Paris, and New York as well as subsidiaries in 20 different African nations. UBA acquired its banking licence to start doing business in the UAE in December 2021. The Central Bank of Nigeria lists it as a commercial bank.

The group’s stock is listed on the Nigerian Stock Exchange, where it trades under the ticker UBA. Tony Elumelu serves as the bank’s group chairman, and Oliver Alawuba serves as GMD/CEO.

United Bank For Africa is a prominent financial services group in Nigeria and throughout Africa. The group’s financial assets were evaluated at 8.5 trillion (US$20.1 billion) as of December 2021, with shareholders’ equity of 724.1 billion (US$1.8 billion).

At the time, the organisation employed almost 20,000 individuals. Nigeria, Ghana, Benin, Ivory Coast, Burkina Faso, Guinea, Chad, Cameroon, Kenya, Gabon, Tanzania, Zambia, Uganda, Liberia, Sierra-Leone, Mozambique, Senegal, DR Congo, Congo Brazzaville, Mali, the United States of America, the United Kingdom, France, and the UAE all have subsidiaries.

Also read:

how to check uba account number using USSD code,

UBA loan Code to borrow money, how to apply,

UBA USSD code full list, everything you need to know

UBA Bank brief history

In 1948, the British and French Bank Limited (BFB) opened operations in Nigeria. BFB was a division of the Paris-based Banque Nationale de Credit (BNCI), which split off its London office to become BFB. Shares in BFB were owned by the Banque Nationale de Credit, S.G. Warburg and Company, and Robert Benson and Company, two British investment businesses.

UBA was established on February 23rd, 1961, to take over the operations of BFB following Nigeria’s separation from Britain.In 1970, UBA became the first bank in Nigeria to launch an initial public offering (IPO) by listing its shares on the Nigerian Stock Exchange (IPO).

The active and quickly expanding Standard Trust Bank, founded in 1990, and UBA, one of the largest and oldest banks in Nigeria, were combined to become the current UBA. One of the largest mergers completed on the Nigerian Stock Exchange, the merger was finalised on August 1, 2005. (NSE). Following the merger, UBA increased brand awareness by acquiring Continental Trust Bank in the following year. UBA bought Trade Bank in 2006 as it was being liquidated by the Central Bank of Nigeria.

In 2007, UBA completed three further purchases of three liquidated banks—City Express Bank, Metropolitan Bank, and African Express Bank—and had another successful joint public offering rights issue. Additionally, UBA purchased Afrinvest UK and renamed it UBA Capital, UK. When UBA continued to buy two liquidated banks, Gulf Bank and Liberty Bank, in 2008, the need to develop a strong local and African brand became more urgent.UBA has a huge global and African footprint.

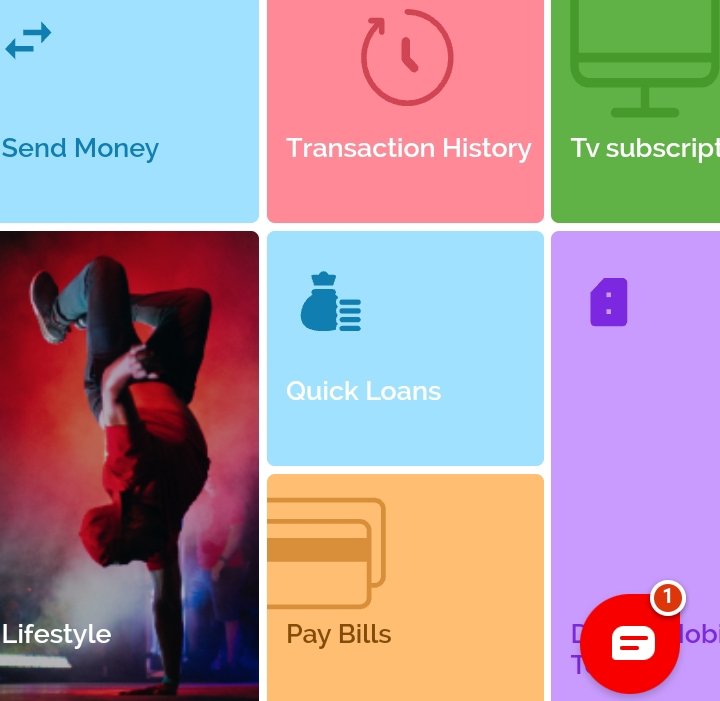

UBA Mobile app

Financial transactions are now easier than ever thanks to the UBA mobile banking app. UBA Mobile banking app make it easy and convenient to transfer money, pay electricity bills, TV subscription, Data and mobile top up from your account, get access to quick loan and full access to your transaction history.

Imagine being able to quickly pay for hotel bills and flight reservations from the comfort of your home. Imagine also being able to buy and transfer money and airtime.

Utilizing the convenience of your home or place of business, the UBA mobile banking app virtually enables you to handle all of the transactions you must complete in the banking hall.

UBA Mobile banking code

UBA mobile banking code is a set of USSD that allows you to carry a set banking services like account opening, fund transfer, airtime and Data top up, flight payment and bills.

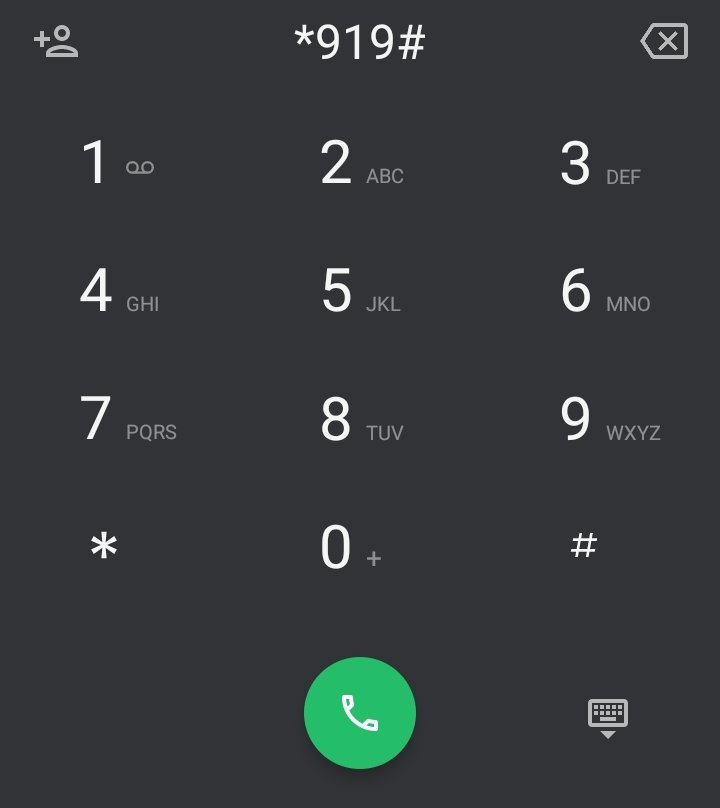

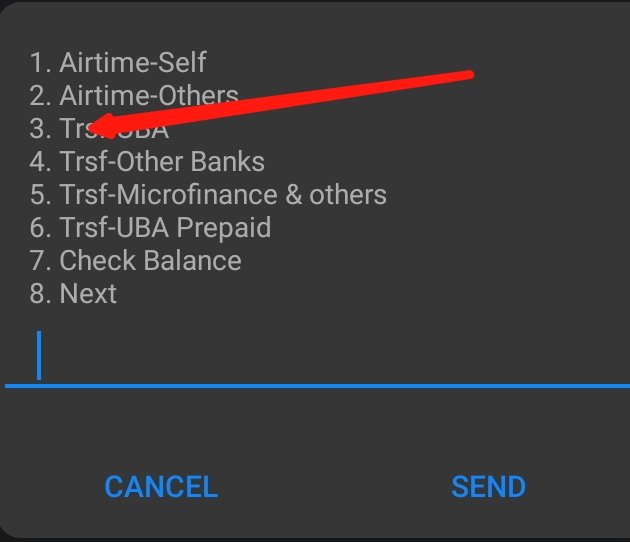

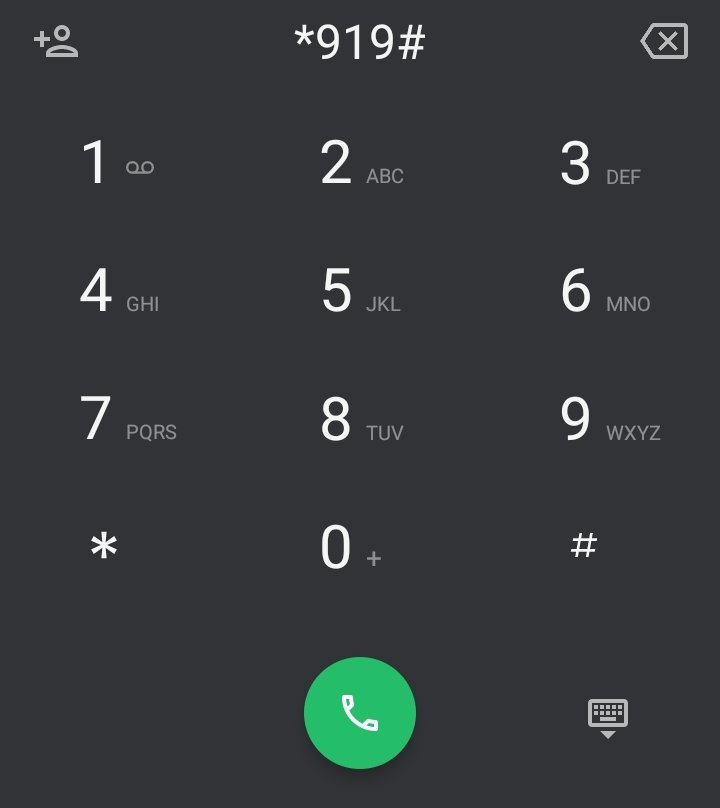

UBA mobile banking USSD to carry out transaction is *919#. With UBA Mobile banking code, you can open a UBA account, transfer funds, buy airtime for yourself, family & friends, pay your bills, pay for your flights and check your account balance all on your mobile phone.

UBA Mobile banking login

UBA mobile banking login is a portal inside the UBA mobile banking app that user’s can input there login credentials to login in other to have access to the UBA Mobile banking app service.

How to open UBA account with your phone

Simply dial a few short digits on your cell phone and follow the simple instructions without using any data. Your mobile phone will receive a message with your account number. So simple, in fact! Visit any UBA business office with your identification to have your account linked to the account in order to take full use of your new account.

Use the USSD code “919# to open your account easily and instantly, there is no fee attached to it, all you have to do is provide all the necessary required details and more importantly, it doesn’t require internet connection and you can dial the number on all network’s in Nigeria for free.

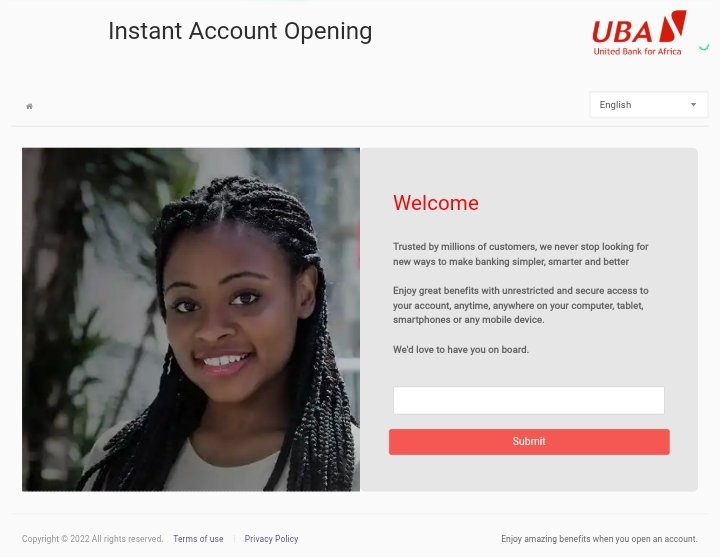

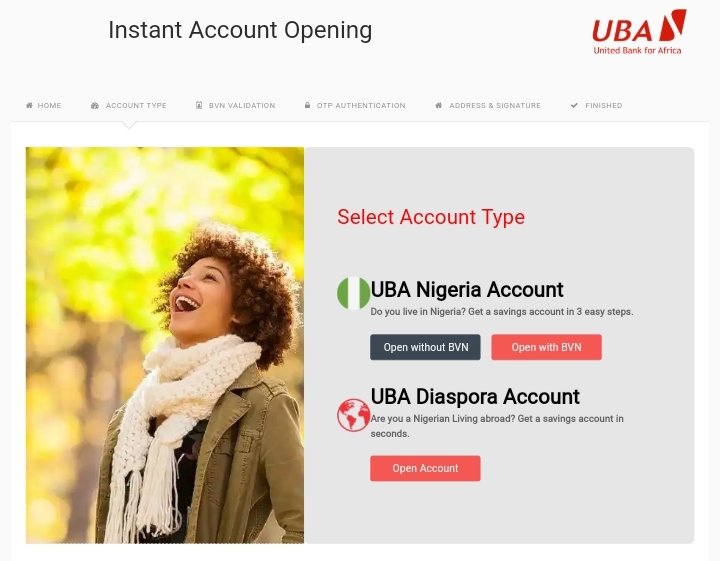

How to open a UBA online account

To open UBA account online, follow the steps below strictly:

Visit UBA official website

Select your country to submit

Select UBA Nigeria account, choose to open with BVN or without BVN and enter the necessary details to open your account .

UBA BVN code

BVN stands for bank verification code, and checking your bank verification code (BVN) on UBA means you are checking your bank verification code (BVN) banking SIM.

To check your bank verification code (BVN) on UBA Nigeria, dial *565*0#

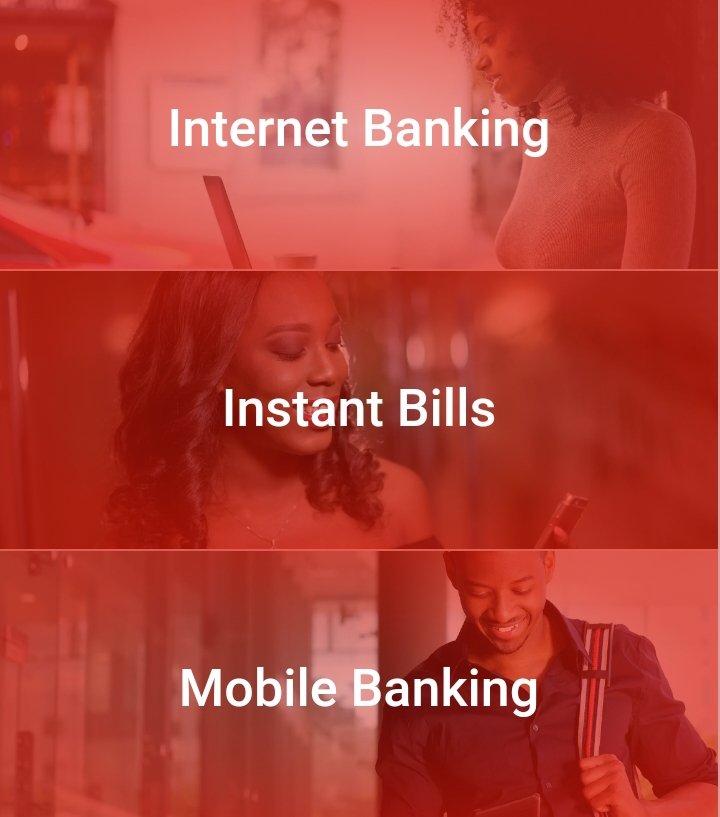

UBA internet banking

UBA internet banking is an online banking service by UBA that allows it’s customer’s to carry out backing service’s online, Manage your accounts, send money, top-up airtime, schedule your bills, save for your goals, and much more.

With UBA internet banking, you can:

- Set spending limit

- Schedule and pay bills

- Make transfers

- Get instant notifications

- Save for your goals

- Open a new account

- Interact in multiple languages

- Sort out transaction disputes easily

- Find a branch or ATM near you

- Lock, freeze, cancel and block your card

- Organise your dashboard

- Select themes to suit your mood

- Wave over your phone camera to hide your balance

- Send money to phone numbers

- Confirm, request, and stop cheques

How to check my UBA account number via SMS?

To know or check your UBA account number, dial *919# on your mobile phone number linked to your UBA Bank account. You will instantly receive your account number via SMS or displayed on your phone.

How to check UBA account balance?

To check your UBA account balance, just dial *919*00#.

As long as you have an account with UBA bank, it is quite simple to check your UBA account balance on your internet-enabled smartphone. The actions you must take are as follows:

- Go to your online banking account and sign in.

- Select “Check Account Balance” to do so.

- The screen will display your account statement.

Use the above step to check your UBA account balance online.

How to check UBA account balance without pin

The code to check your UBA account balance in Nigeria is *919#. You can access it on your mobile phone number linked to your UBA bank account.

All UBA code

Here is a list of all UBA USSD code you should know.

| UBA banking services | UBA banking USSD code |

| Airtime Top-Up for Self | *919*Amount# |

| Airtime Top-Up for Others | *919* Phone number*Amount# |

| Check balance | *919*00# |

| Transfer to UBA Account | *919*3*account number*Amount# |

| Load UBA Prepaid Card | *919*32# |

| Transfer to Other banks | *919*4*account number*amount# |

| Pay bills | *919*5# |

| Retrieve BVN | *919*18# |

| Smile Data Top-up | *919*23# |

| My Bank Statement | *919*21# |

| Block Debit Card | *919*10# |

| ATM cardless withdrawal | *919*30*Amount# |

| Generate OTP | *919*8# |

| Freeze Online Transactions | *919*9# |

| Buy Data (Self) | *919*14# |

| Buy Data (3rd Party) | *919*14*Phone Number# |

| Self-Enrolment – Registration | *919*0# |

| Bet9ja Wallet | *919*22*wallet ID*amount# |

| Baba Ijebu Wallet Funding | *919*26*1# |

| Deactivate UBA USSD code | *919*911# |

| Betking Wallet Funding | *919*26*amount# |

| Lottomania Wallet Funding | *919*26*2# |

| Oak Pensions | *919*27*2# |

| ARM Pensions | *919*27*1# |

How to activate uba USSD code

Follow these procedures to properly activate the UBA Bank Nigeria USSD Code:

- 1. Please enter the mobile phone number associated with your UBA account and turn on your phone.

- 2. Verify that a network signal is available.

- 3. At this point, dial *919# to begin the phone’s activation process.

- 4. From the menu of options that appears in a pop-up notification, choose option “1” to sign up for the UBA USSD code service.

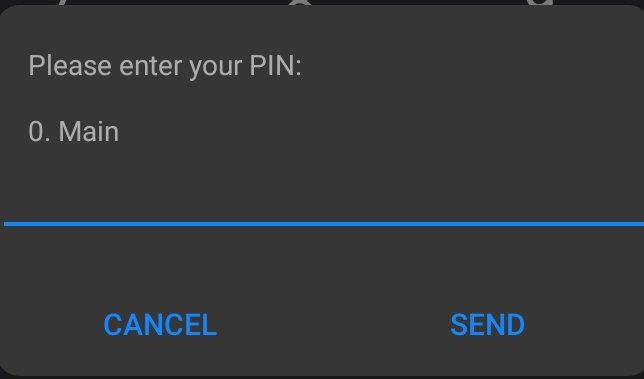

- 5. You will be given the option to register using a prepaid card and PIN or an account number and PIN on the following screen.

- 6. Pick the solution that best suits your needs.

- 7. Enter the UBA Nigeria bank account number next.

- Your UBA debit card’s last four digits must be entered.

- 9. If you have a referral ID, enter it here.

- 10. To activate UBA Mobile Banking, you must enter your PIN at this point.

- 11. Type in your PIN one more time to confirm it before sending it to activate the UBA USSD code on your phone.

Congratulations! The UBA transfer code has been successfully activated on your phone if you followed all the steps above. The UBA Mobile Banking code can be activated in this manner.

How to activate UBA transfer code

To activate your UBA transfer code, you need a registered number associated to your UBA account to register or activate.

To activate your UBA transfer code, simply dial *919# On your phone containing your line linked to your UBA account, follow the on screen instructions, create your PIN to start using UBA mobile banking USSD code.

If you want to send money to any UBA account, simply dial *919*3# and follow up the on screen instructions.

If you want to send money to any other bank, simply dial *919*4# and follow up the on screen instructions.

UBA transfer code

You must sign up for and activate the UBA magic mobile banking app on your phone in order to use it. Dial the UBA code transfer *919# to acquire the PIN to enable UBA mobile USSD banking on your number, then follow the on-screen instructions to utilise the UBA mobile banking service without an ATM card.

- To use UBA’s magic banking, enter *919#.

- You’ll see a welcome message on your mobile device.To register for the UBA USSD code, select option 1.

- The next step is to decide whether to register using your Nuban account number or UBA Prepaid.

- If you are a subscriber to UBA Prepaid, choose “Prepaid With PIN.

- “Choose “Account with PIN” if you do not subscribe to prepaid services.

- Your 10-digit account or prepaid numbers should be entered.

- You should create a magic banking PIN.

- The last four digits of your ATM card or BVN are required for this.

- To finish the registration, confirm your PIN.

UBA transfer code without ATM card

To carry out UBA Mobile transfer without ATM card, simply dial *919# and follow the on screen instructions to complete your transfer.

How to transfer money from UBA to UBA

To transfer money from your UBA account to another UBA users, simply follow the instructions below.

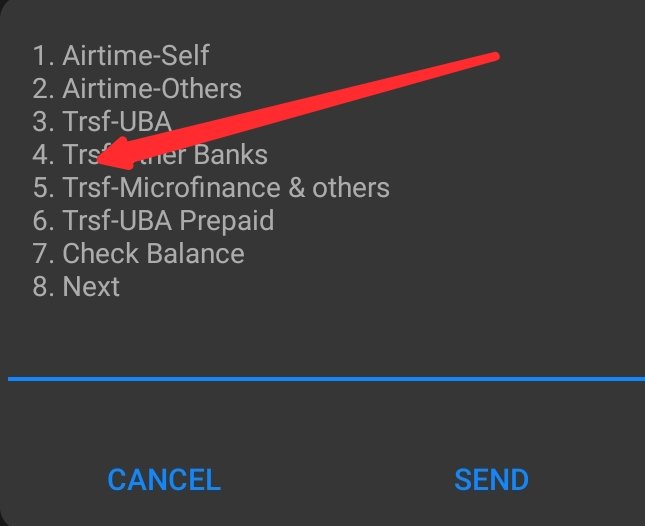

Dial *919# on your phone linked to your UBA account.

On the list of options displayed choose 3

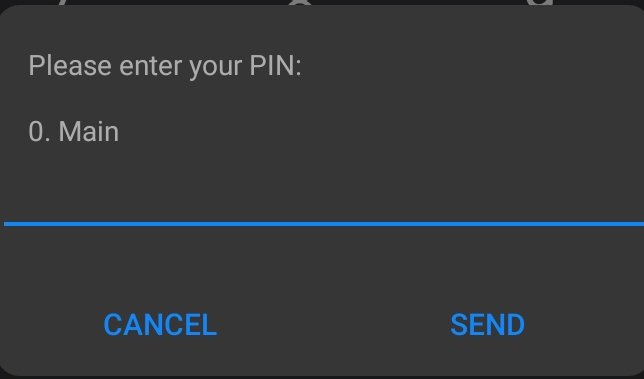

Enter your PIN to proceed

Enter the beneficiary account number

At these stage, confirm your transaction to complete it.

UBA transfer code to another bank

Want to transfer money from UBA to other bank, just follow the guide below strictly.

Dial*919# on your SIM card linked to your UBA account.

From the drop-down menu, choose 4

Enter your PIN

Enter the beneficiaries account number

Confirm your transfer

UBA loan

You should only choose a UBA loan if you want a loan with flexible payment terms, longer credit terms, and less equity.

A UBA Loan will provide you with a way to meet urgent financial needs, from personal loans to asset financing. Additionally, you can use asset financing to take advantage of the loan opportunity and grow your company.

UBA loan USSD code

The quick loan code for UBA Bank Nigeria is *919*28#. All Nigerians with UBA accounts have access to it, and all cell networks allow you to do so. Only the mobile phone number associated with your UBA bank account can access it.

UBA personal loan for salary earners

All salaried individuals can achieve their long-held goals with the help of the UBA Personal Loan product. You can do so much with this product, including pay for self-improvement training, home improvements, paying for medical expenses, boosting your side business, and more.

Depending on your salary and other predetermined terms and conditions, you may be eligible for up to N 30,000,000.00 (Thirty Million Naira). You may also benefit from a flexible loan term of up to 60 months.

The following requirements must be satisfied in order to be qualified for a loan facility: You must meet the following requirements:

- You must run a UBA Salary Account

- Your employer must be on the list of organisations that are authorised to offer personal loans.

Upon submission of the necessary papers, the UBA Personal Loan Facility request takes roughly 48 hours to process and disburse the loan.

The following documentation is required in order to apply for a UBA Personal Loan:

- A loan application form that is properly filled.

- A replica of your pay stub and a bank statement showing your account balance throughout the last six months.

- A notification letter from your current employment.

Features and benefits of UBA personal loan for salary earners

- 60-month repayment schedule that is flexible

- Excellent interest rate (the interest rate will be on floating terms subject to changes in money market conditions, for the period of the loan)

- 1 percent one-time management fee

- N30,000,000 is the maximum loan amount.

- A loan with a N100,000 minimum amount

- You can get access to 50% of your debt service ratio (DSR)

Requirements for UBA personal loan for salary earners

- Account for functional savings or current income

- filled out loan application completely.

- Valid forms of identification include a passport from another country(international passport), a national ID card, a voter card, and a driver’s licence.

- The promise of the employer to keep the salary in UBA.

- properly accepted offer letter or employee inquiry form (the offer letter should contain the employee’s name, job title, and status, as well as the nature of employment (permanent or contract) (Confirmed or unconfirmed).

- A copy of the debtor’s staff ID.

How to apply for UBA loan for salary earners

- Deliver a completed loan application form and any necessary documentation to any branch.

- Execute an offer letter outlining the conditions and terms of the loan after it has been approved.

- Loan proceeds will be deposited into a salary account held by the Bank.

UBA quick loan code

What Is The Code For A UBA Quick Loan. The quick loan code for UBA Bank Nigeria is *919*28#. All Nigerians with UBA accounts have access to it, and all cell networks allow you to do so. Only the mobile phone number associated with your UBA bank account can access it.

UBA customer care number

UBA head office is in 57, Marina, Lagos Island

Lagos State and has branches nationwide, when we need something or need to make a complain, it’s not always easy to visit the nearest branch office, that’s when the need for a customer care number arise.

UBA contact number is (+234) 01-2808822 (2808UBA)(+234) 01-6319822(+234) 07002255-822 (0700-CALL-UBA).

Tel: +234 700 2255 822 (0700-CALL-UBA)+234 1 280 8822 (2808UBA)+234 1 631 9822

Chat Leo on WhatsApp on +234 903 001 0007

UBA email address

UBA Email address is cfc@ubagroup.com

UBA secure pass

When it comes to identity management and transaction authorization across all of UBA’s digital channels, including the UBA Internet Banking solution, Mobile Banking solution, EmailMoni, and others that demand transaction authorization, UBA Secure Pass is the company’s customised version of the mobile token.It was also designed using a “do it yourself” approach, allowing users to self-activate the app without going to a UBA branch.